Practitioners in History: William Soltau Davidson

by Nico Scopelliti

Part One

In the 1870s, New Zealand's young and fragile economy was in crisis. Its main export, wool, was suffering from a global slump in market value, and its other exports, like wheat, simply couldn't make up the difference. English and Scottish land companies with huge holdings in Australia and New Zealand had introduced a surplus of wool into the market, and over a 15-year period, the price of the commodity fell by a third. One such newly-formed organization, the New Zealand and Australian Land Company, was in particularly dire straits. Mismanagement and shady bank dealings had put investors and creditors alike on edge, and threats had been made to liquidate its holdings.

In the 1870s, New Zealand's young and fragile economy was in crisis. Its main export, wool, was suffering from a global slump in market value, and its other exports, like wheat, simply couldn't make up the difference. English and Scottish land companies with huge holdings in Australia and New Zealand had introduced a surplus of wool into the market, and over a 15-year period, the price of the commodity fell by a third. One such newly-formed organization, the New Zealand and Australian Land Company, was in particularly dire straits. Mismanagement and shady bank dealings had put investors and creditors alike on edge, and threats had been made to liquidate its holdings.

A single man — a pioneer and practitioner — not only rescued what would become the most successful land company in the region, but triggered the revitalization and explosive growth of New Zealand's rural economy. At significant risk and tremendous expense, William Soltau Davidson (1846–1924) invested in a barely proven technology that was still in its infancy. In so doing, he created an industry and transformed the destiny of a nation.

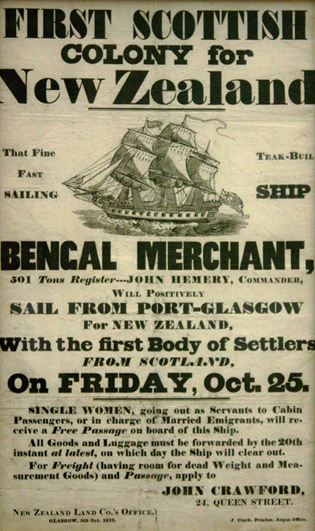

Our story begins in 1865, with a train ride from Glasgow to Edinburgh, and a chance encounter between our hero and a prominent businessman and financier. William Davidson was 19 years old, and having graduated from Edinburgh Academy, he worked at a mercantile firm. He had a head for business and commerce, but desperately sought adventure beyond what we in contemporary times would call "a desk job." He was seriously contemplating moving to Argentina to work on a family member's ranch and learn the management of land holdings.

The day William met James Morton, he was traveling with his father, David, the manager of the Edinburgh branch of the Bank of Scotland. It was during that brief trip that Morton convinced William to join his company, the Canterbury and Otago Association Ltd. No doubt Morton recognized young William's fire and intelligence, and he offered him a cadetship in a company with land holdings half a world away on the South Island of New Zealand. Morton, who was later described in an 1879 edition of The Scotsman as one of the fastest and most convincing talkers in the world of Scottish business, likely saw the benefit of cementing the relationship with William's father, as well, and sold him £10,000 worth of shares in the association to boot.

These dealings of Morton's would in time prove themselves to be both a curse and a blessing to the companies he managed, leading to both their near unraveling and their subsequent salvage and ultimate triumph in the hands of that young man he recruited in the course of a brief train ride, William Davidson.

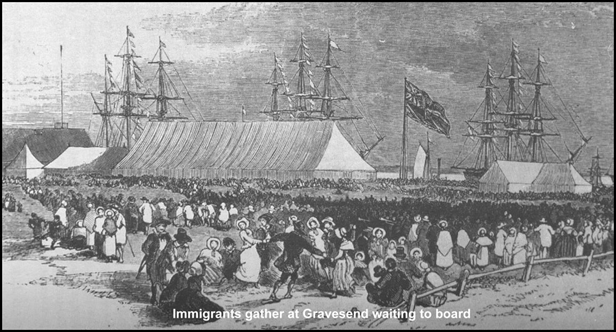

William set sail from Gravesend that summer, and 101 days later, he arrived in New Zealand and started his career in the Antipodes as a shepherd. Humble as it sounds, he learned not only everything there is to know about the husbandry of sheep, but also construction, accounting, and estate management, and eventually land surveying, international trade, and negotiation. Within two years, he was promoted first to overseer, then sub-inspector, and later, superintendent. As his skill and experience grew, so too grew the Canterbury and Otago Association, steadily increasing its holdings and expanding into cultivation with additional purchases of land. And all the while, James Morton expanded his domain from afar in his Glasgow offices, though not through means that would be considered sound financial stewardship.

In 1875, Morton decided to consolidate the holdings of two associations for which he was general manager, the Canterbury and Otago Association, and the New Zealand and Australian Land Company Ltd. This would form an amalgamation so massive that it required a private Act of Parliament to permit the complex procedure of forming a new company with the express purpose of absorbing the two extant associations. By 1877, the consolidation was complete, and Morton appointed William as his successor.

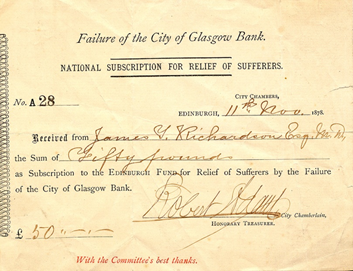

William took the reins as general manager for the newly consolidated association under probably the worst of circumstances. Morton's shady dealings finally caught up with him in 1878, when the City of Glasgow Bank failed. As reported by Richard Saville in his book, "Bank of Scotland: A History, 1695-1995":

"Indeed, the potential losses for Bank of Scotland as a result of the Glasgow bank's failure were serious. The most worrying case was that of the merchant house of James Morton & Co., which has obligations to the City of Glasgow Bank 'to the almost inconceivable sum of £2,300,000' and additional debits due to Bank of Scotland of 'about £340,000'. The origin of these last went back to before 1866, and they were nominally covered by the debentures and shares of the Australian and New Zealand Land Co., which James Morton & Co., had promoted … "

Morton proclaimed his ignorance — and therefore his innocence — of the misuse of the bank's capital in what the August 30, 1879 edition of The Economist referred to as "the greatest mercantile catastrophe and disgrace of the last thirty years." And though he was supported by many in Scotland's financial circles, The Glasgow Herald thoroughly excoriated him for his deep involvement and vexing impunity in the debacle:

Morton proclaimed his ignorance — and therefore his innocence — of the misuse of the bank's capital in what the August 30, 1879 edition of The Economist referred to as "the greatest mercantile catastrophe and disgrace of the last thirty years." And though he was supported by many in Scotland's financial circles, The Glasgow Herald thoroughly excoriated him for his deep involvement and vexing impunity in the debacle:

"How Mr. Morton must chuckle in his thoughtful hours at Elderslie over the fools now languishing in Ayr and Perth prisons. Mr. Morton is the bank's greatest debtor; he assisted in carrying the bank on, unknowingly, he says, to irretrievable disaster and to the ruin of every shareholder connected with it. But he is a free man, preaching his innocence at every opportunity, garrulous and jocular over his many thousands of transactions with it, while his friends the directors and the manager are teazing oakum in the garb of felons. What wretched fools they were so to conduct affairs as to bring them within the meshes of criminal law. Had Mr. Morton been manager or director he would have never done so. He could not have been such a fool! Foolish he may have been - which we deny - but never such a fool as that."

Needless to say, the newly formed and enormous amalgamated association of land holdings over which William Davidson was now general manager found itself in desperate need of strong, sound leadership to weather the financial storm James Morton had brought down upon it. With creditors and liquidators circling like vultures, and a wool-based economy facing ever-slipping market prices, it would take not only strength but ingenuity and foresight to right the ship, lest William's 12 years of work be all for naught.

Part Two

We go on to explore how William rescued the New Zealand and Australian Land Company. It was 1878, and William had just been promoted to General Manager of the newly amalgamated New Zealand and Australia Land Company (NZALC). Although William had been groomed for the position, it is unlikely that he ever anticipated taking the reins amidst a scandal that threatened the company, his livelihood, and the 12 years of work he'd invested half a world away from his native Scotland, on the South Island of New Zealand.

His predecessor, James Morton, the man that recruited him at 19 years of age and considered William his protege, had been long involved in highly questionable banking practices. An attempt to indict him for criminal involvement in the failure of The City of Glasgow Bank was thrown out by the judge, but the court of public opinion found him guilty on all charges. His shady dealings besmirched the name of the NZALC and the rumors swirled. The fact was, however, that while Morton himself owed the bank over £2 million, the Bank actually owed the NZALC money, and the company shouldered no blame for its failure nor the tremendous losses incurred by the people of Glasgow. But guilt by association prevailed, and no person nor company that close to Morton came out of the scandal unscathed.

His predecessor, James Morton, the man that recruited him at 19 years of age and considered William his protege, had been long involved in highly questionable banking practices. An attempt to indict him for criminal involvement in the failure of The City of Glasgow Bank was thrown out by the judge, but the court of public opinion found him guilty on all charges. His shady dealings besmirched the name of the NZALC and the rumors swirled. The fact was, however, that while Morton himself owed the bank over £2 million, the Bank actually owed the NZALC money, and the company shouldered no blame for its failure nor the tremendous losses incurred by the people of Glasgow. But guilt by association prevailed, and no person nor company that close to Morton came out of the scandal unscathed.

Morton was forced to surrender his stake in the NZALC to the bank's liquidators, who then descended upon the company. But as the newly appointed general manager, William stepped into the attack with aplomb. Rather than allow the adversarial nature of the situation to prevail, William fostered a cooperative relationship with them. The liquidators argued strongly for selling off lands held by the company as a means of recouping shareholders' losses. William countered by employing his deep knowledge of the New Zealand real estate market and keen business sense to convince them that maintaining their holdings in the company would be much more to the shareholders' advantage than a hastily-organized fire sale. To persuade them of a rational, strategic, and forward-thinking approach to securing their interests amidst the storm of outrage that engulfed the city was nothing short of brilliant.

As remarkable as was his first success as general manager, William's lasting legacy - and why we celebrate him as a practitioner in history - can be attributed to the ingenuity and tolerance for risk he employed a few years later. This time he stepped into an even bigger attack, one that threatened not only his company, but the continued growth of the New Zealand rural economy altogether.

In William Davidson's time, New Zealand was booming. In 1830, its population was about 800 immigrants. By 1870, five years after William arrived, there were 250,000. An abundance of natural resources and large tracts of pastoral lands attracted pioneers and businessmen of every ilk, chiefly Brits and Germans. And the key commodity forming the very foundation of the young New Zealand economy was wool.

In William Davidson's time, New Zealand was booming. In 1830, its population was about 800 immigrants. By 1870, five years after William arrived, there were 250,000. An abundance of natural resources and large tracts of pastoral lands attracted pioneers and businessmen of every ilk, chiefly Brits and Germans. And the key commodity forming the very foundation of the young New Zealand economy was wool.

Huge shipments of wool exported to the textile mills in Britain fetched a tremendous profit. But it is the law of supply and demand that as more of a commodity is produced, it's value will decline. Such was the case here, and William Davidson watched the price of wool drop steadily from the time he arrived.

It requires no great feat of logic to understand that in order to produce more wool, one must have more sheep. There may have been a few hundred thousand people on the islands of New Zealand, but there were many millions of sheep. My research didn't reveal an estimate for William's times, but as of 2010, there were 32.5 million sheep in New Zealand, a country with a population of about 4.5 million. It begs the question: what did they ultimately do with all of them? The creature producing their primary export has a life expectancy of 10 - 12 years. That's a few million animals per year dying or reaching an age beyond which it doesn't make economic sense to support them and they need to be culled from the flock to make space for younger sheep.

Sheep also produce milk, which can also be churned into dairy products, of course. And they can be slaughtered for their meat. But the problem with those products is that, unlike wool, they're perishable and the markets for them laid half a world away. A ship traveling east from Port Chalmers to London on the clipper route around Cape Horn would sail 12,000 miles and spent an average of 14 - 15 weeks at sea.

Even on a ship laden with tremendous amounts of ice (the typical means of transporting fresh food products of the day) nothing perishable could make it back to London; it was just too far. The markets within reach already burst at the seams with sheep products. And so, they simply disposed of them. William Davidson watched in dismay as entire flocks were herded over cliffs. They were, in his own words, "knocked on the head and thrown down a precipice as a waste product."

Even on a ship laden with tremendous amounts of ice (the typical means of transporting fresh food products of the day) nothing perishable could make it back to London; it was just too far. The markets within reach already burst at the seams with sheep products. And so, they simply disposed of them. William Davidson watched in dismay as entire flocks were herded over cliffs. They were, in his own words, "knocked on the head and thrown down a precipice as a waste product."

Amplifying his dismay at the waste was the fact that an exploding population in Britain - a rather small island by square acreage - already outpaced its capacity to produce food and resorted to importing it from mainland Europe, Africa, and the Americas to meet the need. Never before was the idiom, "one man's trash is another man's treasure," so poignantly true.

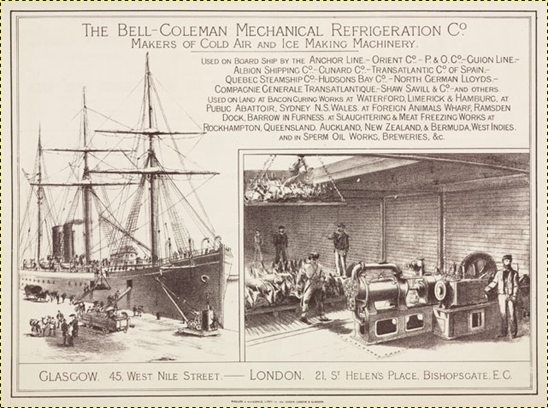

Fortunately, the 19th century was an age of great industrial innovation and scientific advancement, and engineers were already developing machines capable of moving heat from one place to another on a commercial scale, a relatively new technology called refrigeration. Two such innovators were John Bell and J.J. Coleman, namesakes of what we today refer to as the Bell-Coleman Cycle.

In 1877, the year before William Davidson became General Manager of the New Zealand and Australia Land Company, the recently formed Bell-Coleman Mechanical Refrigeration Co. introduced its first cold air machine.

Part Three

In the third and final part, we'll learn about refrigeration in the 1800s, William Davidson's gamble, a ship called the Dunedin, and the first successful shipment of frozen meat from New Zealand to England, a voyage which almost failed and nearly killed the ship's captain.

Having expertly led the New Zealand and Australia Land Company through its first major crisis immediately upon assuming the role of General Manager in 1878, William Soltau Davidson's next challenge dwarfed the first in every imaginable way. It was a challenge faced not only by his company but by all his competitors in the sheep products trade and all of his counterparts in every other trade producing perishable goods. It was a challenge that threatened the growth of the New Zealand economy and hindered the very progress of the developed world as a whole. There were two sides to the problem: one economic, and the other technological.

On the economic side, the market for wool - New Zealand's primary export - was becoming more competitive with every passing year. Supply of the commodity outpaced demand, driving down prices, reducing profit margins, and retarding the growth of the economy.

On the economic side, the market for wool - New Zealand's primary export - was becoming more competitive with every passing year. Supply of the commodity outpaced demand, driving down prices, reducing profit margins, and retarding the growth of the economy.

Yet while wool prices were depressed, the price of another commodity was exploding. As populations grow, so too does the quantity of food required to sustain them. No one is making any more land on which to produce that food, however, and farmers, ranchers, and shepherds don't grow on trees. So when a nation's domestic supply is tapped out, it must look elsewhere for other sources.

Such was the case in 19th century Britain. In William's times, the cost of meat in the UK was skyrocketing. International sources abounded, but few were within the relatively short distance meat could travel before spoiling. The desperate need for a solution even prompted the British government to offer an award of £500 for the first shipment of 100 tons of saleable meat to be delivered to her shores.

Producing huge quantities of wool requires huge numbers of sheep. The New Zealand and Australia Land Company had more sheep than they knew what to do with... literally. So many, in fact, that entire flocks were herded off cliffs, considered a waste product of wool production. Satisfying the UK's need for meat would be a relatively simple matter... if only there was a way to get it there fresh.

Therein lied William's technological problem. Shipping sheep on the hoof was prohibitively expensive - James Morton tried throughout his tenure as General Manager to devise a way to make it profitable, to no avail. The meat could be canned, but that product was not desirable in British markets as it offended the English palate. And no amount of ice would keep the meat fresh over a three month journey spanning half the globe.

Fortunately, chemists and engineers had been working on how to artificially cool liquids and gases for a little over a century, starting with another Scotsman named William Cullen who, in 1755, constructed a small machine which used a vacuum chamber and ether to absorb heat. Benjamin Franklin experimented with volatile liquids which, when evaporated quickly with a bellows, succeeded in dropping the temperature of a thermometer to 7° F, well below freezing. In the 1800s, Ferdinand Carre moved the technology forward by developing gas absorption systems and Carl von Linde (a professor and benefactor to practitioner, Rudolf Diesel) devised ways of using chloromethane, sulfur dioxide, and ammonia (which is still used to this day in industrial applications) as refrigerants. Successive attempts by Jacob Perkins, John Gorrie, James Harrison, and Thaddeus Lowe succeeded in building cooling machines that all failed miserably on a commercial scale.

Thus, the concept of refrigeration was by no means a new one in William's day, but it had yet to be proven in its utility to business or trade.

Throughout his career, William stayed attentively abreast of developments in sea shipping. So when shippers started experimenting with outfitting ships' holds with refrigeration machines, this got his attention. The first attempt to send a load of meat from Australia to the UK took place in 1876. It failed as the machinery broke down and the entire cargo spoiled. In 1877, two steamships successfully transported refrigerated mutton from Argentina to France. This proved it was possible, but it was not a profitable venture. In 1879, a year after William became general manager, a ship sailed from Australia with a small portion of its hold outfitted with the recently introduced Bell-Coleman freezing plant. The meat arrived in good condition.

When he heard the news, William Davidson immediately moved into action. He sent an employee of the company, Thomas Brydone - who filled William's former position when he was promoted to general manager - to England with the mission of exploring their options for refrigeration machines. With that information in hand, William once again employed reason, persuasion, business acumen and foresight to convince the company shareholders to invest a tremendous sum of money into what many considered strictly a gamble, but William knew was the only way forward. By 1880, Davidson and Brydone were carefully designing the new venture.

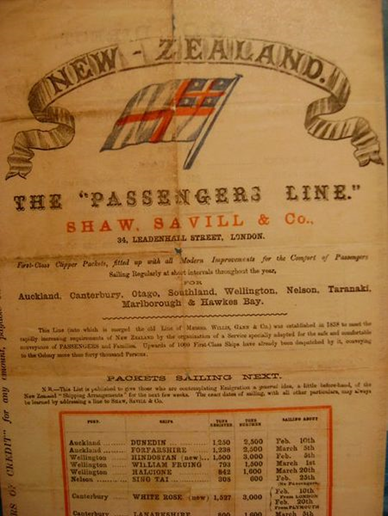

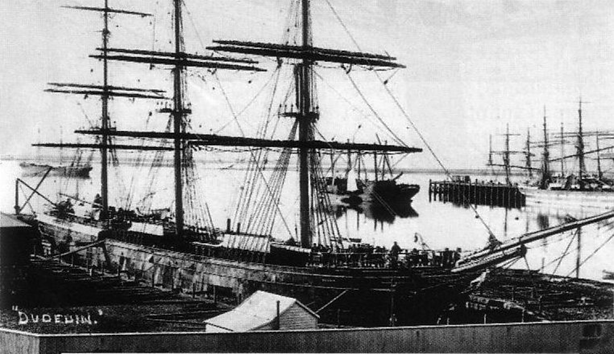

Davidson and Brydone approached James Galbraith of Glasgow whose Albion Shipping Company dominated the New Zealand trade from the UK, transporting Scottish emigrants and carrying the Royal Mail packet. They chartered the Dunedin, a 1,320 ton, 270-foot iron passenger ship used for transporting emigrants at the time. After not-insignificant negotiations, they came to an agreement with Galbraith to have her outfitted with refrigeration machinery. Next, they approached yet another Glaswegian (the demonym for the people of Glasgow), John Bell, of the Bell-Coleman Mechanical Refrigeration Co., and contracted the installation of one of the Bell-Coleman plants on the Dunedin with the intent of maintaining her entire 21-foot deep hold below freezing point. The steam powered plant would require 3 tons of coal per day and would cool the hold 40 degrees Fahrenheit below the ambient air temperature.

The refit of the Dunedin was completed in May 1881. In August she set sail for Port Chalmers in the city for which she was named, Dunedin, on the South Island of New Zealand to arrive in November that year. Meanwhile, William Davidson and Thomas Brydone did not rest on their laurels. The meticulously planned operation called for a new slaughterhouse to be built close to a railway that would be used to transport the fresh carcasses to port in ice boxes.

When the Dunedin arrived, the first carcasses were frozen in the ship's hold and then allowed to thaw as a test. They passed. Then the slaughter-pack-transport-freeze operation began with all due haste. But with operations in full force and 600 carcasses already frozen in the hold, the Bell-Coleman plant's compressor broke down. Despite the calamitous setback, they were still able to sell the meat at local markets and Davidson was encouraged when their buyers were unable to distinguish the previously frozen meat from fresh mutton. Employing local machinists, Davidson ordered the plant fixed, and restarted operations. Over the next two months, nearly 5,000 carcasses were loaded and frozen - about 120 tons of meat. The Dunedin set sail for England on February 15, 1882.

The first time in history a man ever nearly froze to death while sailing in the tropics took place on the Dunedin. The Bell-Coleman plant had been used intermittently along the way - only when needed to maintain the temperature in the hold. But as they entered the tropics, the ship was becalmed in windless waters, and the plant was run continuously. At that time the crew noticed that cold air was not circulating adequately throughout the hold, which not only put a large portion of the cargo at risk of thawing out, but put the ship's captain, John Whitson, at risk of losing his stake in the profits. To what degree Whitson was concerned for the success of the voyage due to his own short- and long-term profits or the thought of making history, we can only speculate. But we can be sure that when he crawled into the hold to saw additional air holes, he was on a mission. While Captain Whitson saved the meat, he nearly died of hypothermia in the process. The crew had to tie a rope to his ankles to hoist him out of the air duct and resuscitate him.

As one would expect, William Davidson was already in London anxiously awaiting the Dunedin. Upon her arrival on May 26, 1882, he wasted no time in boarding and confirming the integrity of her cargo. Amazingly, it looked no less intact and sound than when it left port in New Zealand. Over the next two weeks, the carcasses were sold at Smithfield Market, and out of nearly 5,000 carcasses, only one was condemned. The English butchers who were for the first time processing New Zealand lamb and mutton marveled at its quality. The shipment turned an excellent profit and William Davidson, Captain Whitson, and the New Zealand and Australia Land Company were acclaimed publicly for their historic feat. The May 27th edition of The Times announced the event, reporting:

"Today we have to record such a triumph over physical difficulties, as would have been incredible, even unimaginable, a very few years ago."