Growth and Underinvestment

Systems Archetype 10

Businesses must grow in order to sustain their financial health. A growing concern is a going concern. For many businesses, the challenge to growth is the availability of cash funds to support that growth. That is why it is so important for new startups to have access to investment cash, and why so many small businesses never reach the million-dollar annual revenue level. Underinvestment doesn’t only plague small and young companies; older and larger firms can also suffer from a lack of investment, or a delay in needed investment.

Self-Fulfilling Investment Failure

When senior management saw the original projections for the pea smasher, visions of huge profits danced in their heads. The market looked solid, and the projected unit cost looked great. Finance ran a five-year cash-flow analysis, and declared that the new product would generate sufficient operating income to recover the investment within the first two years.

However, there was a problem with the market projections. While a demand for pea smashers clearly existed, the initial sales never built up like expected. With respectable but below-capacity sales, there was not enough demand for pea smashers to use all of the capacity of the new manufacturing operation.

So manufacturing operations cut costs, reduced labor, and got lean making pea smashers. It was not long until one of the salesmen discovered another use for the pea smashers in the pharmaceutical industry. Engineering developed some new tooling, and the demand grew.

With two different demand markets for the same machine, total demand grew smartly until manufacturing started to feel the capacity pinch. With hat in hand and new plans for an addition to the pea smasher operations, manufacturing approached the senior executives for more investment.

Management, remembering the sting of an ROI that did not happen as planned, delayed making a decision on the capitol expansions. They told the manufacturing managers to find other ways to improve the capacity of the operation without more investment.

The delay in additional capacity was a headwind to demand. The demand increased, lead times lengthened, and some customers turned to other sources. A competitor created an inferior copy of the pea smasher, which put a dent in the demand. Manufacturing and Engineering developed ways to get more smashers out the door each day by using a combination of outsourcing and overtime labor.

As performance increased, the demand increased. Unable to get any more efficiency out of the program, costs went up, and demand slackened. More competition moved into the market, improving their offerings and taking more of the market. By the time senior management finally recognized the need to invest in expansion, the company position in the market had fallen. Now that the company was no longer the market leader, demand for its smashers dropped to below factory capacity, and lower.

What's Happening?

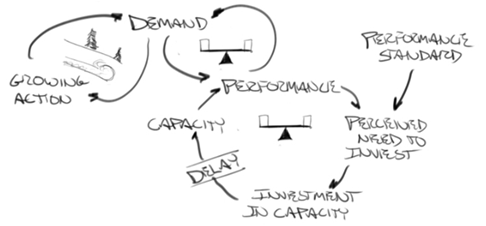

Growth creates pressure on the capacity of the system. As growth approaches the capacity limit, a number of short-term solutions replace investment. These short-term solutions may increase capacity, but eventually growth reaches the practical capacity limit, after which only an investment in additional capacity (plant and/or equipment) can raise the limit. Without the investment, key goals and standards are downgraded, and the growing demand is left unmet. Eventually demand growth stops and demand shrinks, providing a self-fulfilling rationalization for the decision not to invest.

What the People Say

Often decision makers will claim that resources for all initiatives are tight and operations must develop ways to maximize the utilization of the current investment. “There is always room for improvement in your execution. Improve the execution and we will reconsider the investment.” Sometimes the issue is that management cannot see the potential growth beyond the current demand, or cannot see the opportunities for market expansion.

What to Do?

Where there is a real potential for growth, increase system capacity ahead of the demand growth.

- Clearly identify the growth potential: Define all applications, the size of the market for each application, the presence of competing alternative solutions, and the potential market penetration.

- Develop a clear plan to meet growth: Develop a phased plan for growth. Identify the logical capacity investment steps and the execution optimization activities planned to improve capacity between investments.

- Identify risks of missed opportunities: When developing the growth plan, identify the lost market potential and lost revenue and profit dollars associated with the decision delay, or forgo investment in capacity.