Altering the Rule of

Supply & Demand

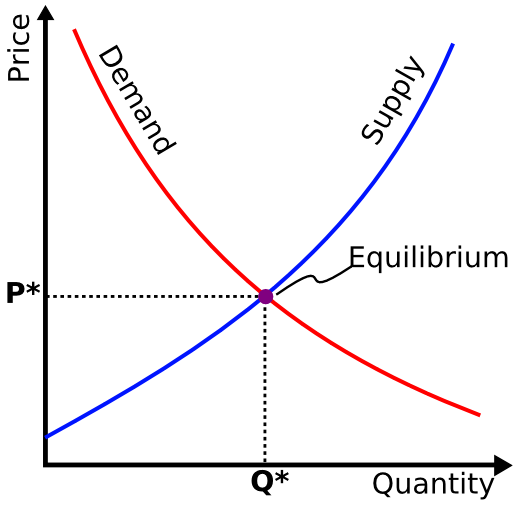

A generally accepted rendition of the law of supply and demand is that if you have a lot of one item, the price for that item should go down. There are times when even if you have a high supply, a high demand will also keep the price high.

A generally accepted rendition of the law of supply and demand is that if you have a lot of one item, the price for that item should go down. There are times when even if you have a high supply, a high demand will also keep the price high.

- ⦁ Demand high and supply low = prices up.

- ⦁ Demand low and supply high = prices down.

- ⦁ Supply high and demand higher = prices still up.

One of the tricks that sellers and producers use to drive prices up, or to prop up prices in a falling market, is to hold back supply. Holding back production is one way to control supply. In the late 1970s, the oil-producing states in the Arabian peninsula learned how much market power they held when they turned off the spigots as a political action. That move led to the strength of OPEC, and to the oil-consuming countries’ fear and loathing of all things OPEC.

A falling market is one in which the demand drops so fast and hard that prices are in free-fall. If you are a commodity trader and are on the sell side of a contract, a falling market is not a good thing. As a buyer, it could be a very good thing, as long as you are willing to wait. As the economy fell in 2008, truckload carriers quickly unloaded tractors and drivers, tightening up capacity in an attempt to support prices. But the economy fell much faster than supply, and some carriers did more than just unload a few tractors and drivers, they went out of business. These carriers did not just get caught in a falling price market; they were squeezed in a rapidly increasing fuel-cost market.

When the demand for your service is falling like a stone, and the cost of one of your major enablers, diesel fuel, is shooting up by 25 cents a week, you get crushed, and that is what we saw in the truckload market in 2008 and 2009.

Truckload freight is like a commodity market. As much as carriers would like to be treated differently, the near-perfect open market in the truckload marketplace makes it hard for a carrier to be something special, unless they are special in what they carry or how they carry it. Not many tanker players, and even fewer explosive haulers, are special according to my definition.

Farmers Changing the Rules of the Game

All commodity markets work this same way. Human activity can control and drive the key pricing in some markets, controlling the pumps in the oilfields. The buys and sells on the Chicago and New York Mercantile exchanges are somewhat driven by the capacity of the pump. Other factors influence fuel prices, such as refining capacity, pipeline capacity, tanker capacity, and the availability of different additives required by regulation.

Weather cycles affect other commodity markets. The seasons change—like clockwork, spring follows winter, summer follows spring, autumn follows summer, and winter follows autumn. In the late summer and early fall, combines make their repetitive journeys back and forth across fields of wheat, oats, barley, and corn. Billions of bushels of grains are pushed through a supply chain, from the farmers’ fields to local grain elevators, and from the local grain elevators upwards through the food supply chain.

Farmers typically do not sell their grain directly to the companies that convert the grain into flour. Middleman agri-corporations, including Cargil, Archers Daniel Midland, and Bunge, buy grain and oil seeds from farms to process themselves, or to sell at a markup to customers such as ethanol manufacturers, livestock and dairy farms, and food companies.

Every autumn, billions of bushels of grain push the supply up. Following the rule of supply and demand, this gives the buyer an opportunity to push for a bargain, with the supply much greater than the demand. The grain middlemen hold an advantage, for they own billions of bushels of grain storage, located in grain elevators along railroad tracks throughout the Midwest. As crops roll in, farmers who lack sufficient storage must sell their autumn harvest immediately to the middlemen, who now have an upper hand in pricing.

That was then. At around the time of the new millennium, however, grain farmers began to invest in on-farm storage, buying silos and bins from makers like GSI Holdings and Brock Grain Systems. These are the two major players in the on-farm storage, or "bins" manufacturing scene. On-farm storage is now at an estimated 12.5 billion bushels. Farmers are still adding more storage in an effort to hold onto their grains until market pricing improves.

This is a way for farmers to improve their balance sheets, shifting pricing power to the farmer. It's estimated that major grain middlemen paid an average premium of about 18¢ a bushel above the Chicago futures price to take delivery of corn in October, 2011. Bloomberg data showed that that was the highest October price in at least four years. Processors were having to bid up the price of corn and other seed grains. Farmers were openly talking about not allowing the middlemen to get cheap corn at the glut of the harvest.

So many farmers have invested in on-farm storage that the middlemen and food producers are becoming concerned. In some years, corn can rise as much as a dollar a bushel between the end of the harvest and the following summer. Additional demands on oil seed grains and corn by ethanol and biodiesel producers create additional pricing pressure.

This is a case of holding on to your inventory to wait for prices to recover. In 2012, farm storage capacity was at a twenty-year high, and the order books at GSI and Brock were full, indicating that farmers were still betting long and hard on improving their grain storage capacity. Farmers are able to do this because of the high demand for grains for both food and fuel production. Farmers are investing in the plant and holding their working capital in dry grain until they can make a better profit.

In the commodity business, the access to storage can become a weapon in pricing.