Powering Natural Gas Trucks: The Costs

Figuring out what a natural gas fueled truck costs to buy and own is hard. In fact, you could say the costs are as clear as mud.

Figuring out what a natural gas fueled truck costs to buy and own is hard. In fact, you could say the costs are as clear as mud.

The price of an NG-powered truck is a moving target, because as demand for the engines and fuel systems grows, the cost of those systems falls. The situation is further complicated by the natural pricing opacity of the truck market, as most heavy duty, over-the-road trucks are made to order, with thousands of options that cause prices to vary, even for diesel-powered trucks. The same goes for the NG-powered trucks, as carriers have different option packages for the engines, transmissions, heaters, and controls.

Now add in the question of fuel system capacity and the question of price becomes much more complex. The question of how much storage to buy is tied to the size and weight of the systems. If the engine uses compression ignition, the fuel systems must not only include the LNG tank, but the diesel and DEF tanks as well, along with the SCR emissions package designed for diesel emissions. If the engine is the spark-ignition variety, the NG tanks must increase in size to make up for the loss of power density that diesel gives to the compression ignition solutions.

Not Much Help

The trade and business press is not much help in pinning down the costs, reporting anywhere from $20,000 to $70,000. If we assume a baseline average Class 8 sleeper tractor cost of $125,000 delivered, the cost to add natural gas power is a premium of 16 to 56 percent. If you read the trucking trade press quotes from the manufacturers who do not offer an NG option, you may see even higher reported premiums.

To write this series, I researched through over 200 different articles and publications, and spent hours looking over different manufacturers' websites. The more I dug, the more I encountered referential circular thinking, and circular references to the costs of the trucks. Through all of the material, the best we can do is narrow down the range of additional cost to the $50,000 spread between $20,000 and $70,000.

A cost spread like that could mean a two-year payback or a nine-year payback. If there is a reason why few fleet operators actually get past the initial evaluation, it is that the problem is complex, and requires work to answer.

Using a Systems Thinking Approach

The only way to understand the additional investment cost for a specific application is to specify a specific application with two options, one with a diesel engine, and the other with the appropriate natural gas engine. A carrier could take their current diesel specifications and price the natural gas equivalent, but that approach ignores an opportunity to right-size the fleet to the application.

Why does a carrier choose Volvo trucks over Freightliners, Kenworths, or Navistars? Why do they choose a 12-speed Eaton manual over the 12-speed Allison? How about choosing 12-liter engines over 13-liter engines? Brands are somewhat subjective – but the warranty of the brand, the dealer network, and the parts programs are all considerations. Brands provide financing, which can be a huge decision driver for a carrier. Engine size, make, model, options — all are subject to a combination of objective study and subjective opinion.

What I propose here is a systems approach to identify the questions that matter, focused on the objective side of the decision. I present the types of questions to ask, but not the answers. Only the fleet manager or fleet owner can answer these questions. What we present here helps with the hardest part of the process — knowing what questions to ask.

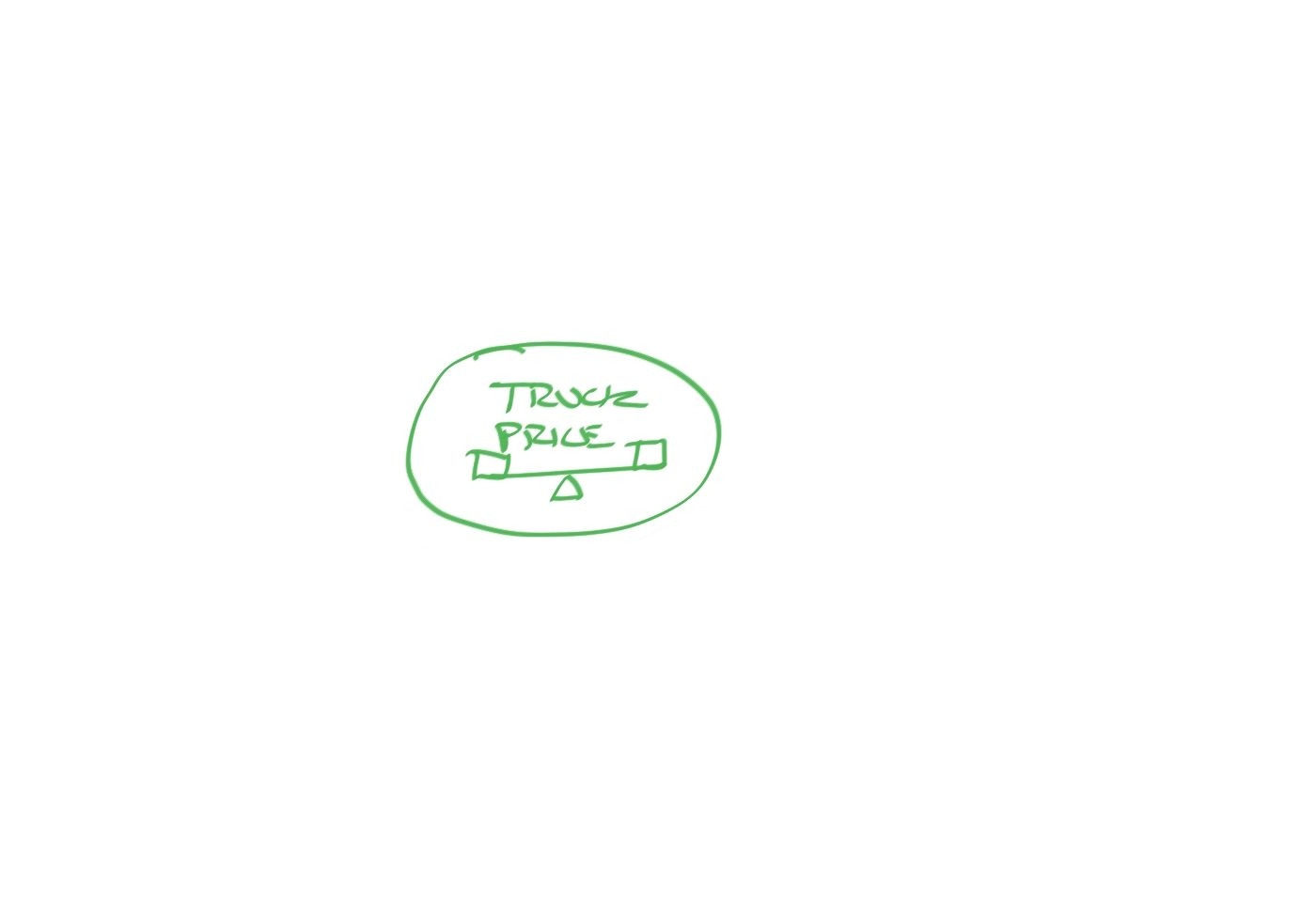

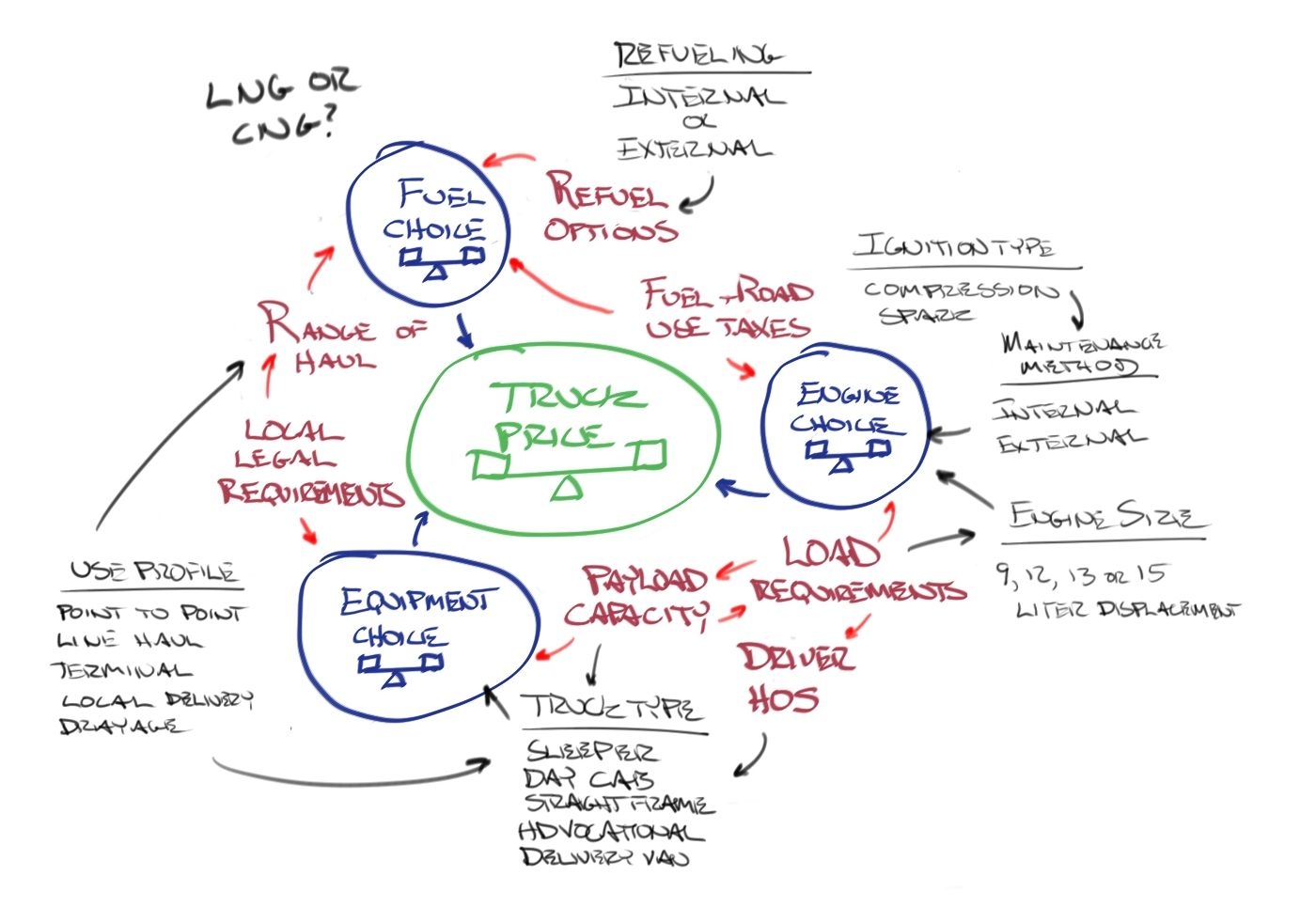

What follows here is a little whiteboard exercise using causal loop diagrams. We will pull back the layers of the onion to help identify the key questions that the fleet owner or manager should ask when specifying the tractor application.

The Core Question: What Does the Truck Cost?

This is the core question we want to answer. As simple as it sounds and looks, there are questions you should think about to define what you mean by the price.

- Will this be a lease or a buy? There are trucking companies that buy assets with the intention of selling them in three to five years, but they still own the trucks. Others lease trucks on a capital lease, with an assumed residual in the end of the process. Define your intentions.

- How long do you plan to hold on to the truck? Some carriers hold a truck for no more than three years; others hold it until they fully depreciate the book asset, while others hold onto the truck until it disintegrates around the driver. Do you define that time as pages on a calendar, or miles?

- What is your intention at the end of your definition of life? Are you selling the truck on the used market? What are you going to assume as your residual value?

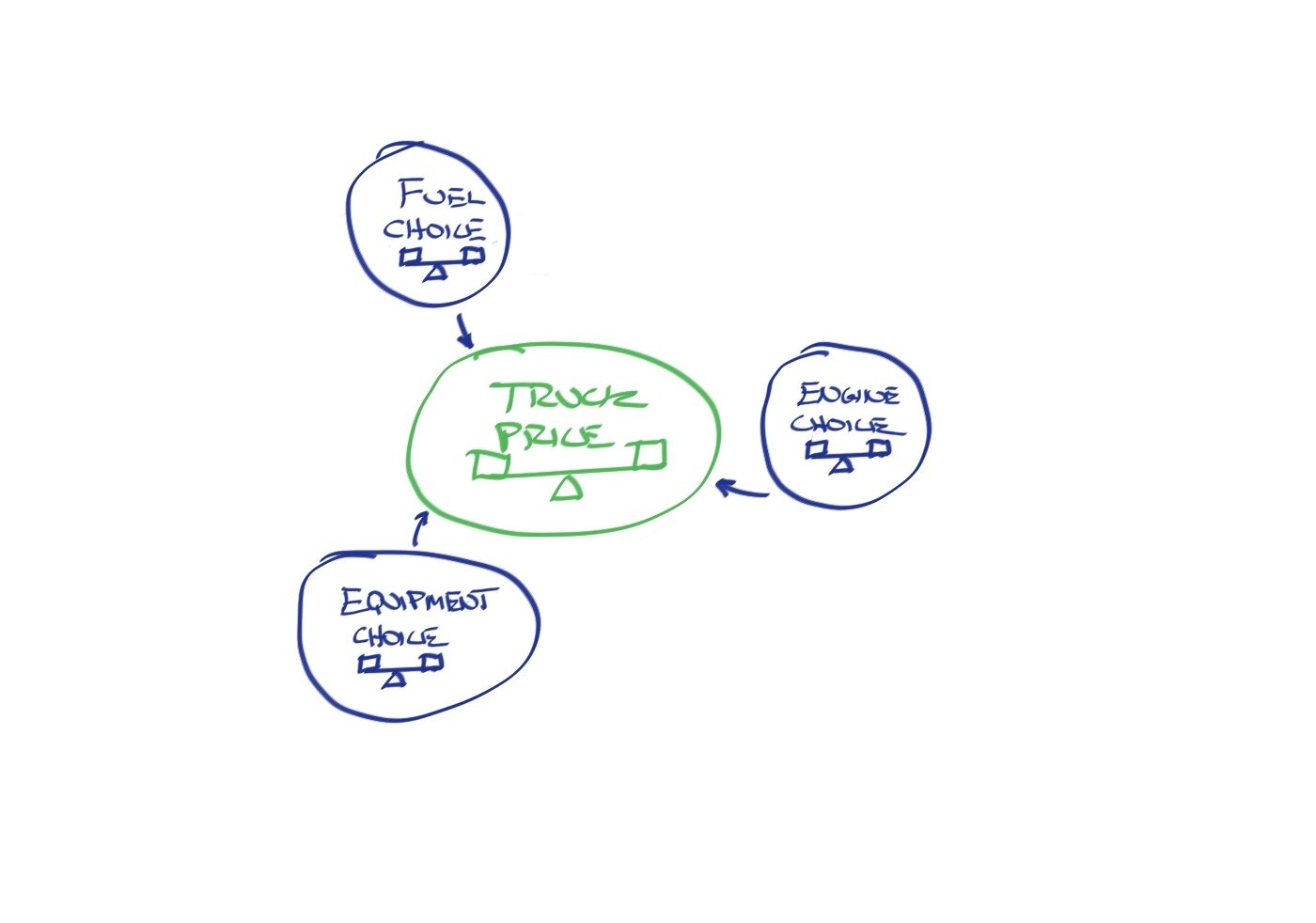

Three Key NG Decisions

There are three key decisions that determine the cost of the NG truck (or any truck for that matter).

- What form of natural gas do you plan to use? Liquid or compressed?

- What size and type of engine will you use?

- What is the rest of the equipment package? This goes beyond the tractor; what is the trailer that the tractor will pull?

Each of these decisions directly affects the base cost of the truck, and affects the cost of the natural gas drive train and fuel system. This is where things start to get more complex, because there many options that affect these decisions; they are not binary, as in yes or no, but multi-variable. That takes us to the …

Key Drivers for the Decisions

If you look at the causal diagram below, it is starting to grow. The question becomes, where to start?

It all starts with load requirements. What is the load being hauled? There is a big difference between delivering parcels on a route and hauling containers from a port. The load defines the payload capacity needed. Load and capacity are key decisions that must be made before choosing the engine and the type of equipment. You don’t put a 16-liter engine in a parcel delivery car, just as a nine-liter engine will perform poorly hauling 44,000 pounds over the Grapevine.

A combination of load requirements and range of haul determine the Driver HOS impacts, which influence the equipment choices.

Local requirements now influence a growing number of markets. The Port of LA Clean Air initiative pushed natural gas engines into the Southern California truck market. Some carriers opted for ultra-low-sulfur diesel, but many realized that the ports could push for even cleaner regulations. In December 2013, the District of Columbia City Council considered placing a ban on the operation of diesel trucks inside the District by 2017. The news quickly spread, with the help of the key trucking lobby known as the American Trucking Association, and the District government backed away from the ban. But the Council did pass a number of Sustainability Initiatives, including tax rebates for alternative fuel vehicle conversion and construction of alternative fuel stations, including CNG and LNG facilities. These are just stepping stones for the next wave of government actions, including some in New York City.

Incentives take many forms. Some are tax rebates for the actual investment. Others are reduction or elimination of fuel and road use taxes. Today, CNG vehicles do not pay a fuel tax at the pump. LNG-fueled vehicles do. Some of the incentives focus on rebate or elimination of fuel taxes, lower toll fees for alternative vehicles, or special lower cost registration. Today, the field is not level, with different incentives for different forms of fuel. While this may change, it is still a factor to consider in the decision process.

The Influencers to the Key Decisions

Now things get complex, as we reach the point in the process where we start to see the key influences — the second-level decisions we have to make to decide what options we want.

Again, the question becomes, where to start?

A variety of factors influence the decision about vehicle type. Payload helps define the equipment characteristics. So does the Driver Hours of Service profile. But the Use Profile — determined by the kind of network the truck operates in — now has influence on the equipment. If the network is a long-distance, point-to-point haul, a Class 8 sleeper cab is the likely choice. But what if the truck operates in a terminal-to-terminal network, like many LT and parcel systems? Then the twin screw day cab is the right answer.

The Use Profile influences the length-of-haul question. Terminal operations, line haul, and local delivery all fit into a network whose trucks can refuel at the terminal, perhaps overnight, opening up the possibility for complete fill CNG operations. Point-to-Point use profiles and drayage where the truck may not return to terminal very often, or where an independent contractor model is the rule, and influences the use of LNG and public fueling stations.

Load and capacity place demands on the engine and drive-train requirements. Typical CNG applications are smaller engines, not right for the heavy loads, as some container drayage operators have learned. More power means larger, thirstier engines that generate more torque. That decision not only drives an operator to look at a higher displacement engine, but perhaps a change in ignition methods, since the compression ignition engines that use a 5 percent diesel mixture create more power.

Combined decisions about length of haul, engine and drive train, and payload capacity determine the fuel choice, and the sizing of the fuel tanks. The fueling plan — using terminal-based supply or public fueling stations — further influences the decision about the size of the fuel tanks and the choice of fuel.

Clearer Picture

Our goal today is to help a fleet manager understand how to answer the key questions that determine the cost differential between a diesel truck and its natural gas equivalent. While the cost differential range is between $20,000 and $70,000 per truck today, we suspect that the costs will drop as more demand builds, and as more fleet managers understand the right questions to ask.

As an added bonus to the article today, we leave you with this video from an Australian company that developed a kit to convert existing diesel trucks to LNG. The approach is interesting because it mixes LNG with diesel across a much broader range of mixtures. How does it perform here in the US, with our EPA regulations? We don’t know. But it looks like it could be an interesting test — a different way to skin the cat than investing in a totally new truck.