KPI Metrics

An Ongoing Discussion

I have been active on LinkedIn since early 2007, when an old boss “invited” me to join his network. I soon discovered the "Answers" section, where people would post questions and other users would supply answers. I loved that area, and just about every day I would dive in and find a question or three to answer.

In those early days, those groups were just a small shadow of what they are today, and they had few functions or features. "Answers" was the action. In the beginning, some of the answers posted to the questions were either uninformed, lame, or shameless sales pitches. I remember a few that gave advice that was the wrong thing to do, and I would dive in whenever I saw these and quickly point out the error.

In those days, if the person who asked the question thought your answer was the best, they would tag it as a “Best Answer.” The first one of those I got felt good, and as time went on I racked up a bunch of them. To this day, if you go to the Supply Chain Management Answers Page you will see that I rank second to Rick Feltenberger in the Best Answer count. Rick has 37, and I have 17.

Since then, group activity has exploded, and there are now 871,000 groups. Some are silly, like the group for people named David or Dave (yes, I am a member), but there are also serious professional groups. In the past, if you wanted to join a group, you had to be accepted by the group manager. Now many groups are open.

I am a member of about 40 groups, and the discussions are the areas where I lurk. It is very much like the old on-line bulletin boards and the Compuserve forums of the 1990s. People post questions, comments, links to their blog sites, and other information, and members are free to post comments.

Which brings us to the real subject of this article. Some time back, Jason Zhuang from China posted this comment in the Logistics & Supply Chain Networking Group:

"I am studying reports to the company's management. What KPIs would you recommend me for a Supply Chain Manager? And what KPI reports I need to request my sub-functions group, like Planning, Purchasing and Sourcing, logistics and transportation (including customs clearance), warehouse?"

Over a period of about 25 days, 65 different people commented on Jason’s question. Some went tactical from the start, suggesting things like In-time delivery, dock-to-dock, inventory turns, cost per unit, cost per cube—any metric you can think of was named. About 15 responses down came the first really strategic guidance from Marcos Barbalho.

“Just remember that fewer are best. The KPI should provide an overall view of the company and not dive into the details. Cost to Serve and Perfect Order are some of the KPIs that I would recommend. There are other statistics that should be collected and used to identify and correct problems as they are identify by the KPI. So if Perfect Order is going down, nothing wrong in looking at Order fill rate, Line fill rate, order lead time, etc., to identify problems but KPI should be much more directional and should be based on the company's Supply Chain strategic initiatives.”

Marcos got strategic with the final sentence of his comment. The KPIs should support the company’s strategy.

I had already thought up my response when I saw Marcos’ post:

“As Marcos shares, 'Less is really more.' If we follow what Drucker teaches us in "Practice of Management," we should first understand what metric the person we report to has to measure and report. For the upward-facing metric, use that as your guide to understand what you want from the managers who report to you.

“Consider that there are metrics that measure efficiency, metrics that measure effectiveness and a handful that measure both. Let us use inbound processes as an example. Cost per unit received is a metric that measures efficiency. It is a great measure, but it brings problems - not all products, vendors, or shipments are alike. The metric also does not measure the quality of your receiving process or the velocity of the inbound flow. Now consider a metric called dock-to-stock: it measures the time between when the truck backs to the dock to the time when all the material has been received, put away, and entered into the system accurately so that it is ready to allocate for shipment. This is a metric that measures your operational effectiveness. It is a measure that your company inventory management team can use to calculate safety stock requirements. It is a measure that is affected by the variable nature of supplier and carrier performance.

“I leave this thought with you. A pilot looks at three key indicators all the time: the altimeter, the compass, and the artificial horizon. There are many other dials on the instrument panel that they look at, but none as much as those three key instruments. What are the three key indicators that keep your operation in flight?”

Far too many operations use far too many KPIs to measure their performance. The Less is More logic focuses on the three things that let you decide at a glance what you must look at in detail. A pilot will look at the altimeter, artificial horizon, and compass more than any other group of instruments. The KEY PERFORMANCE INDICATORS of any supply chain should do the same thing.

More important: what is performance? While productivity is important, effectiveness is far more so. How do you measure effectiveness? What are effective measures? To determine what to use, you must look to the strategy of the company and consider how the supply chain contributes to the success of the company.

How the supply chain contributes will vary by industry and by company.

Perhaps a strategic value to your company is to provide secure, fulfilling employment to the associates. Then, as Lorenzo Murolo suggested, “Think about the effect on human behaviour if the proposed KPI will be measured and reported on.”

Looking to what senior executives use to measure the effectiveness of the company is a great place to start. Robert Shaunnessey suggests, “Start with the important measures that your top management uses to run the company and then choose the supply chain measures that are consistent with their way of managing more than any current issue.”

Bless Tom Craig’s heart for his comment days later: “David has the right idea. KPIs should relate to what the CEO, CFO and COO look at. Too many measures are measures for the sake of measures that are of no use or interest to those outside of the functional area that use it.”

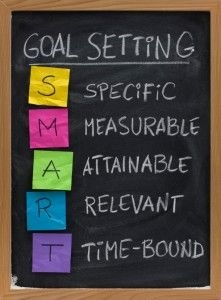

Some folks commented that KPIs follow the SMART goal-setting methodology: Specific, Measurable, Attainable, Relevant, and Time-phased. Some of that logic works, but some is kind of obvious.

Some folks commented that KPIs follow the SMART goal-setting methodology: Specific, Measurable, Attainable, Relevant, and Time-phased. Some of that logic works, but some is kind of obvious.

Specific: sure, that makes it simple and easy to understand, but could it be too specific? Measuring total lead-time from PO release to when the product is in a pick location is specific. To solve problems, you will want to get more specific, but in measuring the effectiveness of the supply chain, you don’t want to be too specific.

Measureable: well, that is an obvious requirement. If you cannot measure it, you cannot manage it.

Attainable: in many ways, your KPIs should be more like mileposts on the road to Utopia. Make your goals attainable.

Relevant: absolutely. I know companies that measure the number of stops on a route, and they make an extra effort to ensure that all loads each day have a minimum number of stops on each route. But in every case I looked at, those companies made that effort to hit the “stops per route” number at a higher cost, with more miles and more driver time on the road—increasing their costs. The number of stops on a route is not relevant. The total cost of delivery is relevant. How about on-time delivery? Perhaps not relevant, depending on the customer; some customers are OK with early arrivals as long as the order is delivered by the due date.

Time-Bound: for goal setting this means setting a deadline for reaching the goal. For KPI, it is creating a periodic reporting structure. How frequently do you report? If you report monthly, your metrics are going to hide quite a bit of performance variance, which you would see if you reported daily.

I will close with a comment about presentation of KPIs. You should always provide two presentations: how you are performing today, and how you have performed over time, i.e., your past performance. Simple graphs are always the best for presentation of both past and current performance. KISS: Keep it Simple…..